For years, professional financial advice has told us one basic rule: save 10% of your income. It sounded reasonable, responsible, and simple. However, the truth is that 10% is no longer enough and pretending it can be is financially catastrophic.

If you’ve been consistently saving and still feel financially anxious or stuck, the problem is not your discipline; the problem is that the rule was built for an economy that no longer exists.

The Origin of the 10% Rule

For several decades, the 10% rule has been a staple of financial advice, popularized in a famous book called The Richest Man in Babylon. This book consisted of a series of parables set in ancient Babylon to explain financial principles. According to the story, Arkad, a former scribe who became the wealthiest man in Babylon, taught the citizens of Babylon how to be wealthy. He would go on to pass down a tablet inscribed with “The Five Laws of Gold”.

The Five Laws of Gold

- Gold flees the man who follows “get-rich-quick” schemes or tricksters.

- Gold slips away from the man who invests in businesses he doesn’t understand.

- Gold clings to the cautious owner who seeks the advice of wise men.

- Gold labors diligently for the wise owner who finds it profitable employment.

- Gold comes to the man who saves 10%

Additionally, the idea of saving 10% can also be traced back to the ancient biblical practice of tithing, by giving 10% of one’s harvest to the church or a temple. And because this practice was ingrained in our minds, giving yourself a tithe seemed familiar and achievable.

The 10% Rule Worked, Once

For over a century, the 10% rule wasn’t just a suggestion; it was a mathematically sound strategy. It began during a period when financial risk was spread across institutions, employers, and governments. Between roughly 1950 and 1990, saving 10% of your income was often more than enough to guarantee a middle-class retirement. Prior to the 90s, personal savings were never meant to be the primary source of retirement income; they were considered one-third of the retirement equation. Employees relied on their job to provide a pension, social security as a safety net, and their 10% contribution for additional spending money. Back then, healthcare costs were affordable, home prices were lower, and retirement lasted fewer years. Savings were treated as a supplement, not your sole financial source at retirement.

But that reality is gone.

The Economy Changed. The Advice Didn’t.

What we now face is a drastically different economy. For our grandparents and great-grandparents, nearly 40% of the private-sector had pensions. Today, that number has plummeted to roughly 11%. The responsibility for funding retirement has shifted almost entirely from employers to the individual via 401(k)s and IRAs. When one-third of that retirement equation our grandparents relied on disappears, the “personal savings” portion has to be twice as great to protect you at retirement.

Secondly, we’re living longer. In 1950, a 65-year-old could expect to live another 13 to 14 years. In 2026, many retirees are planning for 30 years of life after work. If you retire at 65 and live to 95, you are essentially funding a second “work life” that is nearly as long as your actual career.

A 10% savings rate assumes you only need to replace your income for a decade or two. To fund 30 years without a paycheck, you simply need a much larger pile of capital.

Additionally, our fixed costs like housing, transportation, insurance, healthcare, childcare, etc. are consuming far more than they have in previous generations. And this cost has been rising faster than wages. However, saving 10% continues to make us appear as if we’re financially healthy, but the reality is that it’s a false sense of protection. Wages are stagnant, job stability has declined, benefits have shifted from the employer’s responsibility to the employees, and everything seems to be getting more expensive.

What “Enough” Actually Looks Like in This Economy

Modern personal finance advice focuses heavily on savings rates and investment returns but ignores fixed expenses. The uncomfortable truth is that there is no universal number. A realistic savings strategy should first be tied to saving for stability, and growth second. What this means is that, first, we should focus our energy on saving 3 to 6 months of real expenses in cash. While saving 10% is about building long-term wealth, the 3–6-month rule is about preventing financial ruin. The “3 to 6 months” timeframe is based on the average length of a job search. This ensures you don’t have to take the first, and potentially worst, job offer just to pay bills.

Aim for 3 months if you’re single, you rent, and/or have a salaried, high-demand job.

Aim for 6 months if you are married, have children, or care for elderly parents. You are a homeowner, self-employed, and/or the sole breadwinner.

Step 1: Audit your fixed cost

Housing, transportation, and insurance determine everything. If you can lower these, that can have just as much of an impact as getting a raise.

After you have calculated your monthly living expenses, you aim to save at least 15-20% of your income to build up your 3-6 months of expenses.

Step 2 : Find a high yield savings account (HYSA).

This will be designed to cover your essential bills if your income suddenly disappears. The primary reason to use a HYSA is the annual percentage yield (APY). Focus on building liquidity before chasing returns. Flexibility matters more in the beginning. Building this cushion before long-term investing is important primarily to prevent you from having to dip into your retirement accounts, creating a taxable event.

Over-investing while under liquid looks smart on paper but can be catastrophic in real life. The best advice I recommend is to build your finances around a minimum savings amount. Create a non-debatable pact with yourself that you will not allow your life’s wants to outweigh how much you pay yourself.

Step 3: Get rid of bad debt

Now is the time to begin paying down any debt with high interest rates higher than what you can earn in the market (typically 7%)

- Credit Cards

- Student Loans

Step 4: Long-Term Savings

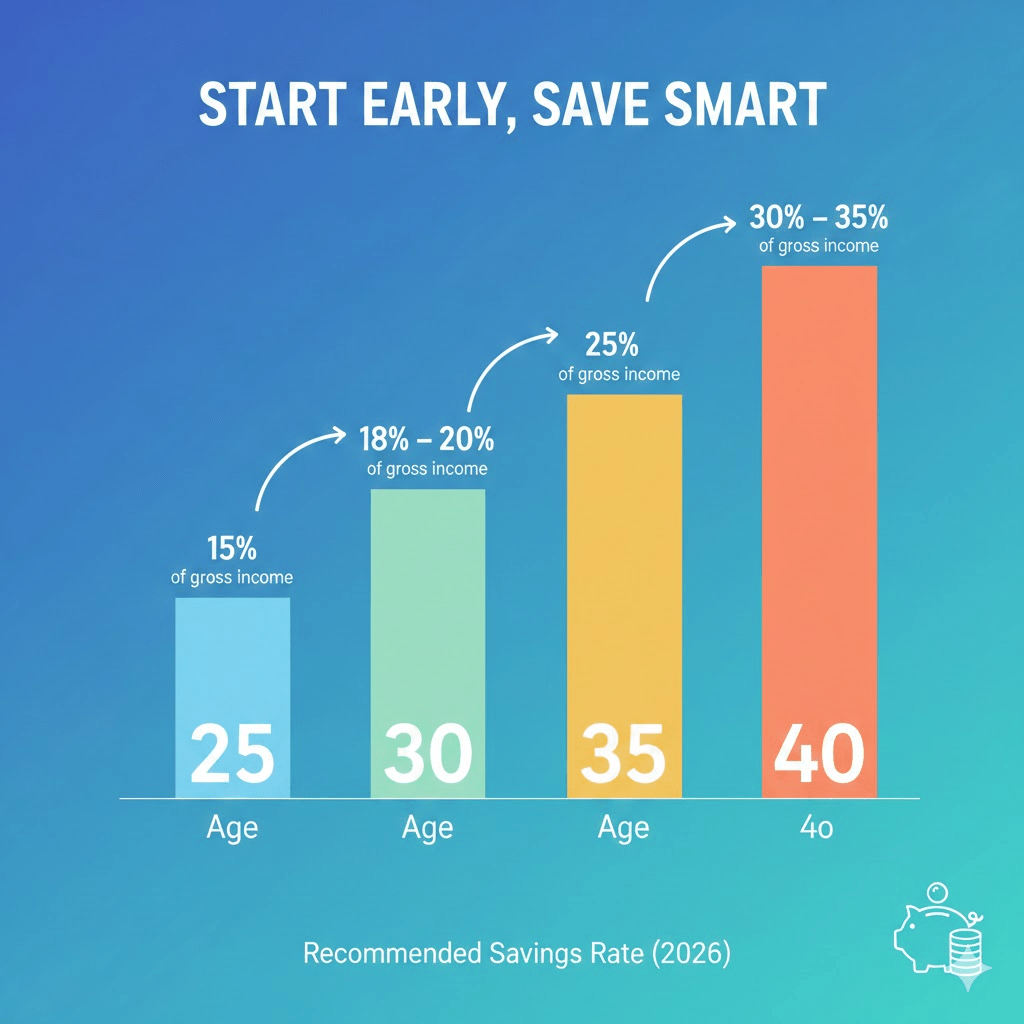

Once you’ve built a financial cushion, pay down bad debt, and accelerate your retirement contributions. If your employer offers matching, this is the priority. Invest the specific amount to max out your employer’s match. Afterwards, compare different retirement vehicles depending on potential return percentages. The priority after matching is to max out your retirement accounts. While there is no one-size-fits-all answer, one recommended savings rate to use as a guideline, depending on when you start (a simple calculation). Fidelity and other benchmarks base the 15% recommendation on a worker who starts at age 25. If you start later, the percentage required to maintain your lifestyle rises dramatically due to the loss of compound interest

.

Step 5: Stress Test your budget annually

Once a year, start back at step 1 and recalculate your 3-6 months of monthly expenses and adjust as necessary. This is a necessary step. Most financial plans become outdated over time due to increases in fixed costs and a failure to reassess your budget.

Retire the Rule, Keep the Discipline

Look, nobody wakes up excited to stare at a spreadsheet. The old “10% rule” was great because it was simple; however, the truth is, life has become more expensive compared to previous generations.

Building wealth isn’t about being perfect or living on ramen noodles for the next decade. It’s just about making sure “Future You” isn’t getting stuck with the bill for “Current You’s” life.

If all of this sounds massively overwhelming, and I understand if it does, pick one of these 3 things to do in the next 24 hours.

- 1% challenge: Bump your retirement contribution up by just 1%. It’s the price of a couple of coffees a month. You won’t feel it now, but your 65-year-old self will definitely want to buy you a drink for it later.

- The Simple Audit: We all have that one $15 subscription for a streaming service or gym we haven’t touched in months. Kill it. Then, set up an automatic $15 transfer to your savings. You’re not “spending” less; you’re just redirecting the money back to your own pocket.

- Park Your Cash: If your emergency fund is sitting in a big-name bank earning 0.01% interest, you’re basically giving the bank a free loan. Take five minutes to open a High-Yield Savings Account. It’s the closest thing to “free money” you’ll find in 2026.

Financial freedom isn’t a race; it’s just a series of small, slightly smarter moves. You don’t have to be an expert—you just have to start

0 comments on “Why Saving 10% of Your Income Is No Longer Enough—and Might Be Lying to You”